Child Plan™ is a Tax-Free Trust for each Grandchild

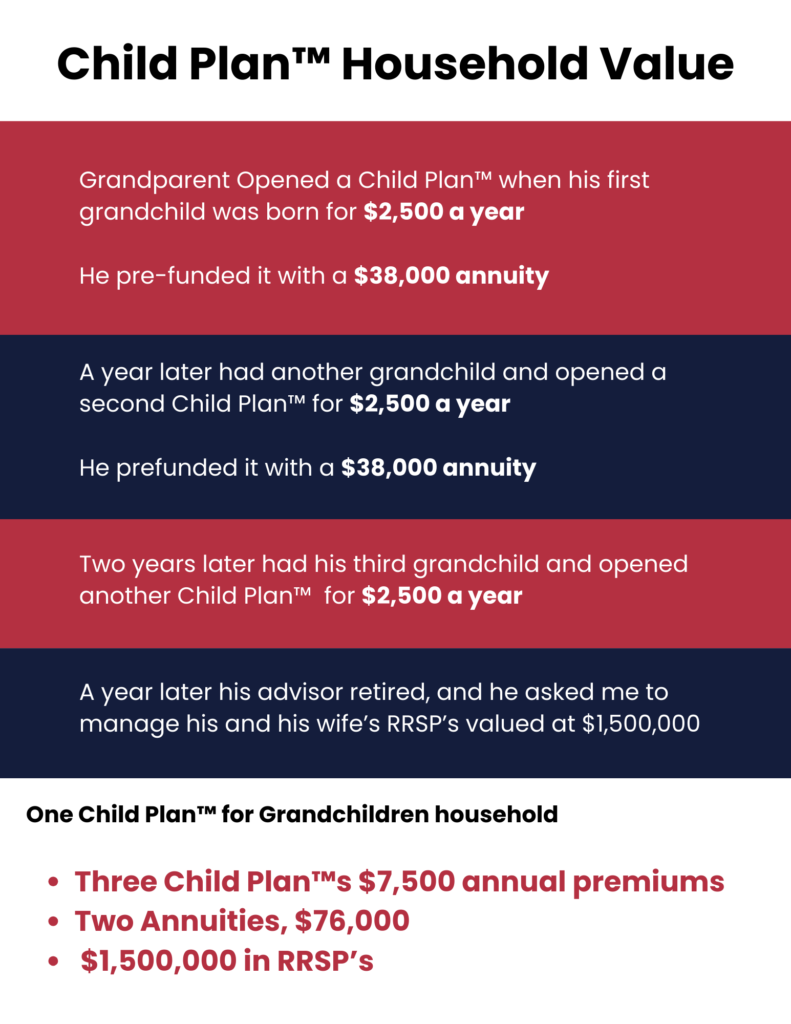

Can open a Child Plan™ for each Grandchild, separately

Each Grandchild will receive Tax-Free annual dividend for life

Can transfer Child Plan™

Tax-Free to their child to hold in trust for their Grandchild

Can transfer their wealth

Tax-Free directly to each Grandchild

Can prefund their Child Plan™ and get up to a 35% discount